Orbis Reel Sector Simulation

Promotion Information

Main Software Program : It is the main accounting, reporting, sales/marketing program that can be used by all businesses.

Simulation Program: It is a training program that will work on the main software.

Interim Program : It is an interim software program that enables the enterprises that buy the main program to access the data in the accounting systems of their branches, authorized dealers, authorized dealers, distributors or similar sub-organizations if requested.

Solution Context

The simulation program to be prepared for training will be a program that will work on the main software program which is being developed for the purpose of accounting, reporting, sales/marketing operations of enterprises operating in the real sector. Therefore, before the main software program will be developed and its sub-organizations (branches, dealers, vendors, distributors, etc.) will be used and the simulation program will work on this main software. As the training will be carried out using this simulation, all participants will be as comfortable as working on their firm software and will recognize the system in depth.

Network-wide standardization will be ensured by the use of the same main software sub-organizations (branches, dealers, resellers, distributors, etc.) affiliated to the main organization, so that the main enterprise can directly access the necessary data of the sub-organizations (branches, dealers, resellers, distributors, etc.) when needed.

Technical Substructure

All software programs are being developed on ORACLE 12C DATABASE (Database) and ORACLE FUSION MIDDLEWARE FORMS/REPORTS 12C development tools are used. The software application is implemented on Microsoft Windows and is provided by ORACLE WEBLOGIC 12C. In addition, because ORACLE supports cloud technology, the entire application can also be carried out on tablet and mobile devices if requested.

Main Software Program

This software program was developed to record and follow up the accounting procedures of small/medium-sized enterprises operating in all sectors of business, to record and follow up sales/marketing activities and to report all activities and aims to eliminate the weaknesses of existing software programs used by enterprises of this size.

The existing software programs used by SMEs, which are widely used, are only programs that can produce reports in accordance with the Tax Procedural Code (V.U.K.) and have poor reporting characteristics. The software program we are developing has been prepared not only according to V.U.K. but also to produce records and reports in accordance with International Accounting Standards (I.A.S.) and International Financial Reporting Standards (I.F.R.S.); it is designed to ensure measuring, monitoring and reporting foreign currency risk, interest rate risk, liquidity risk, credit risk and operational risk. In this context, it will be possible to monitor the interest rate risk that can be generated by the balance sheet items such as accounts receivable (trade and non-trade receivables) , accounts payable (commercial and non-commercial debts) and financial and non-finacial loans used by the companies using this software, foreign currency risk arising from balance sheet items in foreign currency, any credit risk generated by any type of futures sales (with checks/notes receivables or open account receivables) without cash collection, the liquidity risk of all transactions, and may instantly measure the operational risk that may occur according to certain criteria, and the profit/loss to be generated by these risks in the income statements.

In addition, it will be possible for companies to monitor their balance sheets in terms cash in hand and market price of company which can be calculated according to current interest rate, exchange rate and other corrections. In other words, the records, financial statements and reports of the enterprises are generated in the bank's sensitivity.

Simulation Program

Simulation software program will be given as a free product to be used for the training of its employees in sub-organizations (branches, dealers, resellers, distributors, etc.) of enterprises using the main software program; in the case of enterprises that do not use the main software program, they will be offered only as a training program. The simulation program will work on the main software program that is detailed above and will use all the features of this program.

All users participating in the training will be given the right to set up one and/or more than one company (sales company, maintenance/repair company, etc.) with equal capital at the starting point and equal authority of the parent company. After this point, alternative scenarios will be prepared by the training moderator (trainer) and the main firm will approve and the information, offers and options appropriate to selected and approved scenarios will be presented in a common area.

From this point onwards, the participants will start to take action in accordance on behalf of their own risk and management understanding and will avoid some of the transactions they deem unappropriate when making the necessary transactions. For example, while some participants prefer to work with more stock, some will prefer to carry less stock, surplus stock bearers are exposed to inventory costs, while those who prefer low stock will have shortage of goods to sell in sudden demand increases. Those who choose to sell in advance will not have any liquidity problem, but will experience profitability problems; term sellers will experience liquidity problems while they will not have any profitability problems.

Moderator (trainer) will change interest rates and foreign exchange rates from time to time, the maturity of the receivables and maturity of debts. Participants’ companies having the maturity of the receivables that are longer than the maturity of the debts and/or the receivables that are more than the debts will suffer losses in the increasing interest rate conditions; while participants’ companies having the maturity of the receivables that are shorter than the maturity of the debts and/or receivables that are less than the debts will suffer losses in the decreasing interest rate conditions.

Similarly, enterprises bearing open positions against foreign currencies (companies with higher foreign currency denominated liabilities than foreign currency denominated assets) will suffer losses in the increses in exchange rate conditions; while long position bearing enterprises (higher foreign currency denominated assets than foreign currency denominated liabilities) will suffer losses in decreasing exchange rate conditions. All transactions will be carried out only with an acceptance click and all accounting records will be produced automatically by the system.

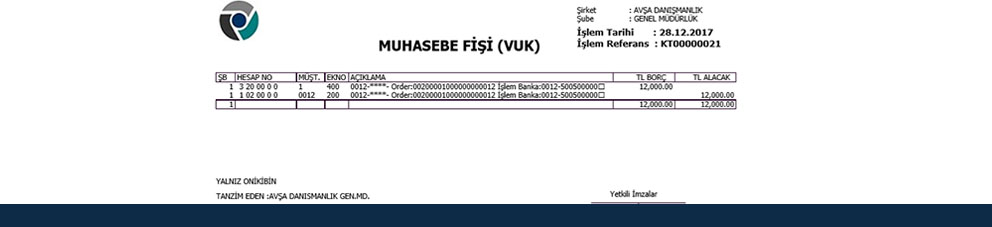

When the sessions are finished, the end-of-day operations will be performed and the foreign currency exchange evaluation transactions, interest rates accrual operations will be performed according to the current exchange rate and interest rate information, and the financial tables prepared according to both V.U.K. and I.A.S. and I.F.R.S. will be presented to the participants.

The trainer will examine the financial statements together with the participants, explain the reasons and the sources of the figures and then move on to new sessions. Each session will be equal to one month period and there will be one year financial statements after 12 sessions. In the last session of the training, the financial statements will be reviewed in detail; participants will be given information on the strengths and weaknesses of one-year management experiences, in addition, a written report will be prepared for each participant if requested by the main firm.

Duration of Training

Simulated training period is designed as 3 days. Considering that the theoretical training is designed as 2-3 days, in order not to block employees for one week, it would be beneficial to do two trainings at different times, not one after another, however, too much time between two courses may cause problems as a result of erosion of knowledge gained in theoretical education.

Required Hardware and Equipment

The most necessary condition is a high-speed internet connection. In addition, other training materials such as later announced configuration and up to the number of users, the client computer, a printer connected to these computers, uninterruptible power supply, projector, financial calculator in the number of participants, notepads are required. Windows 10 Premium must be installed on all computers. Training notes and system manual will be prepared by the trainer.

There will also be a need for a training room that will accommodate all participants, hardware and equipment. The operations that the installation of the network between computers, installation of the simulation program, testing of hardware and software, troubleshooting of possible errors will be done a few days before the training. The information technology and hardware specialist will be in the training room during the entire training and will intervene in the memory of any problems.

The cover page of the book that contains the information that is the source of the accounting software infrastructure of the system is shown below (Hakan Şakar). This book will be distributed as educational grade in simulation trainings.